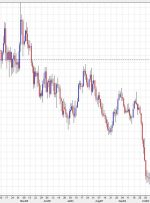

[ad_1] Market Week Ahead: Gold Tests $2k, GBP/USD, EUR/USD Pop, USD Sags Markets remain risk-on with a range of US equity markets posting fresh multi-month highs. The VIX ‘fear gauge’ is at lows last seen at the start of 2020 and has fallen in excess of 46% from its late-October spike high. The growing feeling