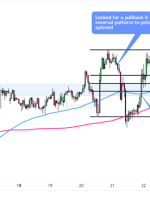

[ad_1] Gold (XAU/USD) Analysis, Prices, and Charts Macro backdrop remains supportive for gold. The 200-day simple moving average is now in play. Recommended by Nick Cawley How to Trade Gold According to a range of media reports, US President Joe Biden and Israel’s government have agreed to a relief plan that ‘minimizes civilian casualties and