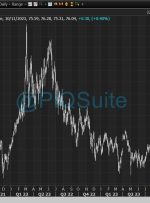

[ad_1] This article focuses on the technical outlook for EUR/USD, Nasdaq 100 and crude oil (WTI Futures), taking into account sentiment analysis and recent price action dynamics. Most Read: US Dollar Forecast – Fed Pivot Ahead? Setups on USD/JPY, GBP/USD, AUD/USD For a comprehensive assessment of the euro’s medium-term outlook, make sure to download our