[ad_1] Seasonal patterns in the financial world are akin to well-guarded secrets that successful investors leverage to their advantage. These patterns are recurring price movements that occur during specific timeframes or around particular events. In this article, we delve into some of these patterns and tips for their optimal use. Additionally, we will explore how

[ad_1] Config Sets for SMC OB v3.5 (MT4/MT5) These Config Set Files are based on optimization conducted on the symbol with the following settings parameteres: TimeFrame: M15 Data Model: Every Tick Based on real Ticks (NOT OHLC, with this we strive to make the data quality as close to real therefore we dont use OHLC) Deposit: $100,000.00 USD Leverage: 1:100 Optimization: Fast Genetic

[ad_1] These are possible reasons EA Utility may stop working or freeze, in the case EA Utility is well written code but still problem persists Problems : 1. MT5 Beta build : Any build which is not stable version may cause problems to any EA Utility 2. Conflict with any indicator : Indicators runs on

[ad_1] The Smart Trading Tool Kit: In this blog you will learn about our: Best trading systems: We will list the best and most advanced professional trading systems in the world. We’ve worked hard with our development team to find and share the world’s top professional trading systems. Mission and Vision: We will share with

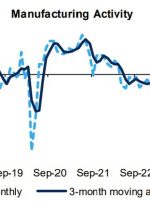

[ad_1] Prior month +5.0 New orders -4 vs +3 last month Services index -11 versus +4 last month Shipments +9 versus +7 last month Employment +7 versus +7 last month Wages +29 versus +23 last month Availability of skills needed -1 versus -10 last month Prices paid +3.02 versus +4.06 last month Prices received +2.07

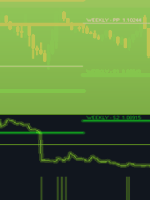

[ad_1] Hello Traders, we had a trade on CHFJPY on H1 time-frame that today 24 October 23 the market already moved +3000 Points! In this trade we looked first at green candles from Italo Trend showing that the market is going to trend. The last confirmation of the trend trade were the neon green line

[ad_1] Config Sets for RSI STORM v3.1 (MT4/MT5) These Config Set Files are based on optimization conducted on the symbol with the following settings parameteres: TimeFrame: H2 Data Model: Every Tick Based on real Ticks (NOT OHLC, with this we strive to make the data quality as close to real therefore we dont use OHLC) Symbols: EURUSD,EURGBP,EURAUD,EURCHF,EURNZD,USDCAD,CADJPY,GBPUSD,GBPCHF,GBPAUD,AUDCAD,AUDCHF,NZDUSD,NZDCAD,NZDCHF Deposit: $100,000.00 USD Leverage: 1:100 Optimization: Fast

[ad_1] Share: The latest data on Tuesday showed that the preliminary S&P Global Australian Services PMI posted 47.6 in October from 51.8 in September. On the other hand, the Manufacturing PMI eased to 48.0 from 48.7 in the previous reading. Furthermore, the Composite Index came in at 47.3 versus 51.5 prior. Market reaction At the press