[ad_1] The major US stock indices are trading at session lows as European traders start to look for the exits for the week. The NASDAQ index is now down around 1.3%. The S&P index is down -0.89%. All the major indices are back below its 50 day moving averages after closing above those moving averages

[ad_1] USD/JPY, Nikkei News and Analysis Japanese officials consider all options amid evidence of currency speculation USD/JPY rises on dollar bid, nervously eying the psychological 150 mark Nikkei on track for fifth consecutive day of gains, bull flag provides optimism The analysis in this article makes use of chart patterns and key support and resistance

[ad_1] © Reuters. Investing.com– The People’s Bank of China said on Friday that it will cut the amount of foreign exchange that is required to be held by banks, as it moves to stem further weakness in the yuan and support a slowing economic recovery. The PBOC said it will cut the foreign exchange reserve

[ad_1] Despite good economic data like lower core inflation, stable jobless claims, lower inflation expectations and strong consumer spending that support the soft-landing narrative, the S&P 500 just keeps on falling with very shallow pullbacks. One of the main reasons might be the non-stop rally in long term yields and real yields as it makes

[ad_1] Article by IG Chief Market Analyst Chris Beauchamp FTSE 100, DAX $0, Dow Jones Analysis and Charts FTSE 100 finds support at 7500 The previous three sessions have seen the index dip to 7500, but buyers have come in to defend this level each time. This leaves open the possibility of a renewed move

[ad_1] Article by IG Chief Market Analyst Chris Beauchamp Nasdaq 100, CAC40, Hang Seng Analysis and Charts Nasdaq 100 holds support for now The price rallied off the 15,260 level yesterday, stemming any further declines for now.Crucially it also held trendline support from late April and remains above it in early trading today. A rally

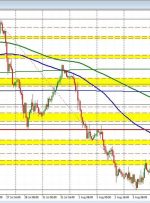

[ad_1] The AUDUSD followed the trend in the US dollar to the downside, but Azucena reversal over the last few minutes. Technically the price moved above its 100-hour moving average of 0.65975. It also moved above a swing area between 0.6595 and 0.6603. The high price reached 0.6607 but has since rotated back to the