[ad_1] GOLD (XAU/USD) PRICE FORECAST: MOST READ: USD/CAD Remains Rangebound as Canadian CPI Falls More Than Expected. Where to Next? Gold prices continue to find acceptance above the $2000/oz a step to far. Yesterday saw an aggressive push above the resistance level only foe the Daily Candle to close back below the psychological level. Another

[ad_1] High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do

[ad_1] Share: HSBC hands TSLA stock a Reduce rating and price target of $146. Tesla stock is consolidating right on top of $210 support level. HSBC analyst says too much of Tesla growth story comes at end of decade. President Joe Biden supports UAW attempt to unionize Tesla factories. Tesla (TSLA) stock

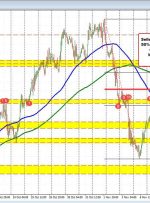

[ad_1] EUR/USD, PRICE FORECAST: WEEKLY FORECAST: Gold Price Forecast: $1950 Key Support Approaches as Bears Eye Further Downside The Euro appears to be gaining some traction against the Greenback of late. The 1.0700 handle however has proved stubborn with EURUSD unable to maintain gains once crossing the threshold. Markets continue to remain optimistic that the

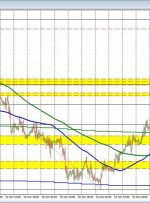

[ad_1] The USDCAD raced lower last week and continued that fall yesterday to a low of 1.36284. However, the move lower stalled, and the price moved back above a swing area between 1.3659 and 1.3668 (and held support on a dip). Sellers turn the buyers and that momentum has continued in trading here today. The

[ad_1] US yields continue their move lower: 2-year yield 4.924% -14.6 basis points 5-year yield 4.620%, -19.8 basis points 10-year yield 4.706% -16.8 basis points 30-year yield 4.906% -11.8 basis points At the start of the Asian-Pacific session, US yield curve look like the following: 2-year yield 4.954% -12.1 basis points 5-year yield 4.662% -15.6

[ad_1] Share: Fed Chairman Jerome Powell will speak before the Economic Club of New York. Powell’s comments on monetary policy and interest rate path will be scrutinized by markets. The US Dollar could show significant reaction to Powell’s speech before the Fed’s blackout period begins on Saturday. Jerome Powell, Chairman of the Federal

[ad_1] GOLD ANALYSIS & TALKING POINTS Gold prices bounced in early Friday trade Action looks corrective after heavy falls, doesn’t seem backed by a specific event US PCE inflation numbers will be the next big indicator Recommended by David Cottle Get Your Free Gold Forecast Gold Prices managed a little bounce in Friday’s European trade

[ad_1] More again from Bank of Japan Governor Ueda, trying his hand at some verbal intervention to support the yen. Who wants to tell the Gov that a 500-odd bp yield differential between the US and Japan is a very strong fundamental that is moving the USD/JPY rate? Ueda: important for FX to move stably