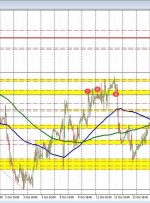

[ad_1] Are you having trouble making consistent profits in forex trading? The foreign exchange market can be very volatile. This can quickly take away your money. Many traders lose a lot because they don’t manage risk well. But, there’s a way to fix this. By using smart money management, you can keep your investments safe.