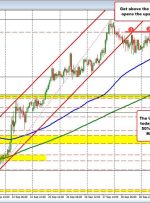

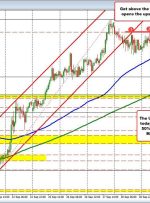

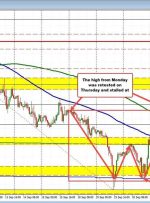

[ad_1] The miss in the ADP report yesterday gave the market a bit of relief after a series of strong economic data like Jobless Claims, ISM Manufacturing PMI and Job Openings. The ISM services PMI has also printed bang on expectations, and coupled with the other reports, supports the soft-landing narrative. Moreover, the market was