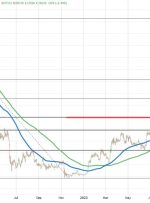

[ad_1] The price of bitcoin has extended to the highest level since May 2022. The high price has reached $38408 Bitcoin moves above and away from the 38.2% retracement Looking at the daily chart above, the price of the digital currency moved above the 38.2% of the move down from the 2021 high at $69000