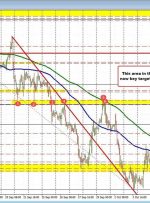

Article by IG Senior Market Analyst Axel Rudolph FTSE 100, DAX 40, and S&P 500 Analysis and Charts FTSE 100 capped by resistance The FTSE 100 has seen six consecutive days of gains, on Thursday driven by energy and health care stocks, but has come off the 200-day simple moving average (SMA) at 7,650 as