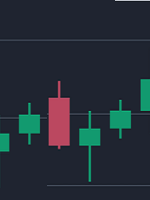

Investors are favoring the euro and British pound today, Friday, as they await the US employment report that may indicate steady hiring ahead of a potential downturn. The report, however, might not offer clear guidance on future Federal Reserve policy due to overlooked household financial conditions and strikes. Economists predict an increase of 173,000 jobs