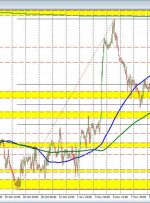

Share: Gold was able to gain something of a foothold again at the start of the week. Economists at Commerzbank analyze the yellow metal’s outlook. Gold likely to tread water ahead of US inflation data Gold’s recovery potential is likely to remain limited ahead of the US inflation data due to be published