[ad_1] Market Recap Wall Street continued its decline for the second straight day (DJIA -0.54%; S&P 500 -0.70%; Nasdaq -1.17%) with growth sectors bearing the brunt of the sell-off once more, as market participants de-risk in the lead-up to the upcoming US Consumer Price Index (CPI) release. Over the past week, the Nasdaq is down

[ad_1] Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making

[ad_1] Advantages of Using RSI in Forex The popularity of RSI as a forex indicator is a product of its distinct advantages as a research and evaluation tool. Top benefits of using RSI include: It utilizes a simple mathematical formula. Unlike other technical indicators, the math behind RSI is simple enough that traders could do it

[ad_1] The major US indices opened higher and moved even higher in the early trading for the day. Stocks are reacting to lower yields with the 10 year now down -7.4 basis points. The thirty-year is down -3.7 basis points. A snapshot of the market 12 minutes into the open and showing: Dow industrial average

[ad_1] Market Recap Major US indices ended the day slightly underwater (DJIA -0.19%; S&P 500 -0.25%; Nasdaq -0.10%), as the US 10-year Treasury yields continue to head to its highest level in almost nine months, following through with the recent announcement that the US Treasury would boost its issuance of long-term debt this quarter. Recommended

[ad_1] DOLLAR INDEX, USD/CHF PRICE, CHARTS AND ANALYSIS: Recommended by Zain Vawda Get Your Free USD Forecast Most Read: US Dollar Forecast: ‘Soft Landing’ Narrative Gains Traction Post FOMC US DOLLAR, FITCH RATINGS DOWNGRADE The US Dollar and Dollar Index (DXY) faced a slight pullback as yesterday’s US session began winding down as Fitch Ratings

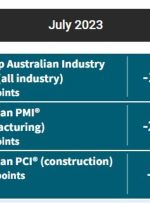

[ad_1] The latest from the Australian Industry Group is dour reading. Link here for more, but in summary: Key findings The Ai Group Australian Industry Index indicated contracting conditions in June, for the fifteen months since the start of the current interest rate rising cycle. The Australian PMI indicator fell to -25.6, indicating contractionary conditions

[ad_1] Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making

[ad_1] Market Recap Recommended by Jun Rong Yeap Get Your Free Equities Forecast The new trading week kickstarted with a drift higher in Wall Street overnight (DJIA +0.28%; S&P 500 +0.15%; Nasdaq +0.21%), as sentiments remain largely on its cautiously optimistic state ahead of more big tech earnings releases and the US job report this