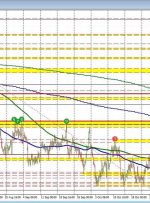

BITCOIN, CRYPTO KEY POINTS: Bitcoin Trades Just Above the $38k Mark. Are We Finally Going to Print a Daily Close Above the Resistance Level with an Eye on the $40k Handle? Binance Users Pull $1 Billion Following the Exit of CEO Changpeng Zhao. BNB Token Struggles and Hovers Near Recent Lows. Can the Exchange Survive