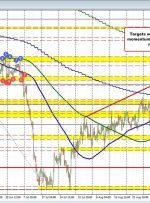

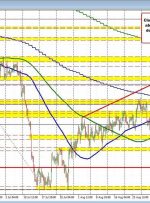

[ad_1] The USDCHF traded sideways and then moved lower on Wednesday before finding support near 0.89347, basing and moving to the upside. The Swiss National Bank kept rates unchanged on Thursday helping to propel the price even higher, with the price moving above its 200-day moving average of 0.90334. The surge on Thursday did find