[ad_1] EUR/USD Forecasts – Prices, Charts, and Analysis US dollar may slip lower into the weekend. US earnings start in earnest today with a handful of banks on tap. Recommended by Nick Cawley Get Your Free USD Forecast The US dollar rallied by over one big figure yesterday after the latest US inflation data release.

[ad_1] Article by IG Chief Market Analyst Chris Beauchamp Dow Jones, Nasdaq 100, Nikkei 225 Analysis and Charts Dow at one-week high The index surged on Monday, rallying back towards the 200-day simple moving average (SMA). This comes after the gains made on Friday following the payrolls report. For the moment a low appears to

[ad_1] Share: USD/CAD continues the losing streak due to the improved Crude oil prices The Mid-East tension persists; and contributes support for the oil prices. Investors downplay the likelihood of additional rate hikes following the dovish remarks made by Fed officials. USD/CAD continues the losing streak on the fourth successive session, trading lower

[ad_1] Gold, XAU/USD, US Dollar, Treasury Yields, Israel, Federal Reserve, GVZ Index – Talking Points The gold price has held the high ground going into Tuesday’s trading session Treasury yields appear to have rolled over after making new highs last week The US Dollar is under pressure despite global uncertainty. Will XAU/USD keep rallying? Recommended

[ad_1] Share: Canadian Dollar sees gains for holiday Monday as Crude Oil catches a bid on Israeli-Hamas conflict concerns. Canada markets are dark for Canadian Thanksgiving, in conjunction with the US Columbus Day holiday. It’s a quiet week on the economic calendar for the Canadian Loonie, investors to focus on US CPI inflation

[ad_1] Share: EUR/USD catches a firm lift post-US NFP release, climbing 1.12% from the day’s bottom. Broad-market flows have gone firmly risk-on following a bumper NFP reading for the USD. Euro traders will be looking ahead to Monday’s investor confidence indicator for October. The EUR/USD climbed 117 pips from Friday’s bottom bids of

[ad_1] The major US indices are closing higher for the day. The gains came despite strong and expected US jobs report and higher yields. Traders are hoping that the tame wage data and the unemployment rate remaining unchanged at 3.8% (expected 3.7%) will keep the Fed on hold. Next week we get key consumer price

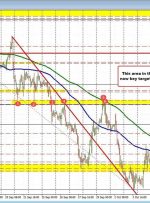

[ad_1] Whether you like the price action or not, the technicals in the EURUSD told the story for the price action. Initially, the price moved sharply lower after the stronger-than-expected nonfarm payroll add. That move took the price to a key support level at 1.0483. I’ve outlined that level as a key downside target to

[ad_1] © Reuters Investing.com – The U.S. dollar traded higher Friday, on course for another positive week, ahead of the release of the monthly U.S. nonfarm payrolls which could influence Federal Reserve thinking. At 03:40 ET (07:40 GMT), the Dollar Index, which tracks the greenback against a basket of six other currencies, traded 0.2% higher