Share: Economists at RBC Economics do not expect the Federal Reserve to deliver more rate hikes. Monetary policy at its current level is already very restrictive Easing inflation pressures in the US against a resilient macroeconomic backdrop have been encouraging and have raised hopes that inflation can slow back to the Fed’s 2%

Article by IG Chief Market Analyst Chris Beauchamp FTSE 100, DAX $0, Dow Jones Analysis and Charts FTSE 100 finds support at 7500 The previous three sessions have seen the index dip to 7500, but buyers have come in to defend this level each time. This leaves open the possibility of a renewed move back

Article by IG Chief Market Analyst Chris Beauchamp Nasdaq 100, CAC40, Hang Seng Analysis and Charts Nasdaq 100 holds support for now The price rallied off the 15,260 level yesterday, stemming any further declines for now.Crucially it also held trendline support from late April and remains above it in early trading today. A rally back

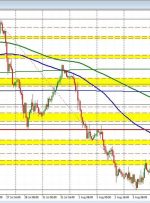

Euro, EUR/USD, US Dollar, Fed, USD/JPY, Hang Seng, China, Fibonacci – Talking Points Euro support wilted after US Dollar resumed strengthening today The Fed reminded markets of their intention and Treasury yields responded If EUR/USD breaks above near-term resistance, will it make a new high? Recommended by Daniel McCarthy How to Trade EUR/USD n The

The AUDUSD followed the trend in the US dollar to the downside, but Azucena reversal over the last few minutes. Technically the price moved above its 100-hour moving average of 0.65975. It also moved above a swing area between 0.6595 and 0.6603. The high price reached 0.6607 but has since rotated back to the downside

Article by IG Chief Market Analyst Chris Beauchamp FTSE 100, DAX 40, Nasdaq 100, Prices, Analysis and Charts FTSE 100 claws its way back from Thursday lows Thursday witnessed an impressive recovery from the lows of the session for the index. Having slumped briefly to a three-week low the price has now rebounded. A follow-through

Gold, XAU/USD, US Dollar, DXY Index, Treasury Yields, GVZ, Fibonacci – Talking Points The gold price has been sidelined in a week of action elsewhere The US dollar and Treasury yields have found firmer footing amidst the risk aversion Volatility has ticked up a notch. Does it imply a move ahead for XAU/USD? Recommended by

Earlier today, Saudi Arabia announced that it will extend its voluntary 1 million barrels per day (mbpd) oil production cut through September. They added that the cuts could potentially be extended or deepened. Following this announcement, Crude oil prices increased by more than $1. The momentum has continued. The price is currently up over $2.12

DOLLAR INDEX, USD/CHF PRICE, CHARTS AND ANALYSIS: Recommended by Zain Vawda Get Your Free USD Forecast Most Read: US Dollar Forecast: ‘Soft Landing’ Narrative Gains Traction Post FOMC US DOLLAR, FITCH RATINGS DOWNGRADE The US Dollar and Dollar Index (DXY) faced a slight pullback as yesterday’s US session began winding down as Fitch Ratings Agency