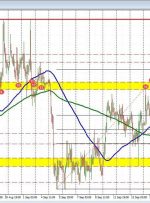

[ad_1] The AUDUSD moved higher in trading today. Fundamentally, the RBA meeting minutes showed that the debate was for a 25 basis point hike which helped to support the AUDUSD in trading today. The move to the upside extended in the early North American session up to the high price from last week (on Friday)