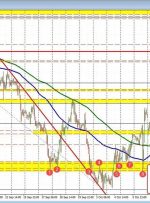

[ad_1] Share: EUR/JPY climbs for the second straight day, breaking above 158.92, but closes at 158.74. BoJ’s ultra-loose monetary policy pressures JPY, while positive EU data reduces a possible ECB rate hike. Technical analysis shows potential for further gains, with YTD high at 159.76 as next target for buyers. EUR/JPY climbed for the