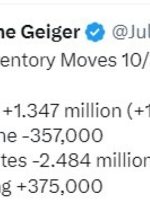

[ad_1] This is from the privately surveyed oil stock data ahead of official government data tomorrow morning out of the US. Via Twitter: I had seen a different number elsewhere for the distillates. — Expectations I had seen centred on: Headline crude -0.3mn barrels Distillates -1.5 mn bbls Gasoline -0.8 mn — This data point