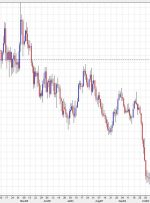

[ad_1] FOMC INTEREST RATE DECISION KEY POINTS The Federal Reserve stands pat on monetary policy, keeping interest rates unchanged at 5.25%-5.50% for the second straight meeting Forward guidance leaves the door open for further policy firming Gold and the U.S. dollar display limited volatility after the FOMC statement was released as traders await Powell’s press