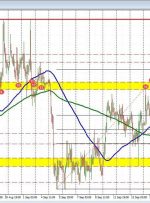

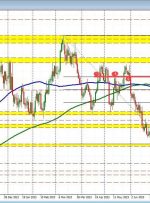

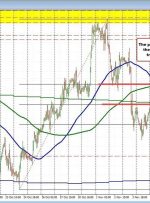

[ad_1] The USDCHF is higher on the week, but the price action has been up and down, especially over the last 4 trading days. Technically, the price has been moving above and below technical levels like the: 200-day moving average currently at 0.8999, 100-hour moving average currently at 0.9044, and the 50% midpoint of the