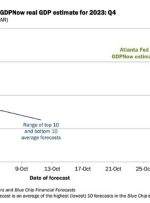

[ad_1] The Atlanta Fed GDPNow initial estimate for Q4 growth debuts at 2.3%. In their own words The initial GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2023 is 2.3 percent on October 27. The initial estimate of third-quarter real GDP growth released by the US Bureau