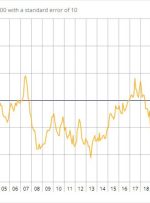

[ad_1] University of Michigan Consumer Sentiment Prelim was 63.0 Prior was 68.1 Details: Current conditions 70.6 vs 66.7 prelim (71.4 prior) Expectations 59.3 vs 60.7 prelim (66.0 prior) 1-year inflation 4.2% vs 3.8% prelim (3.2% prior) 5-10 year inflation 3.0% vs 3.0% prelim (2.8% prior) The Fed might be concerned about that bump in inflation