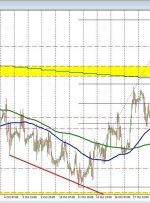

[ad_1] Share: EUR/GBP maintains its upward momentum, trading at 0.8731, as it solidifies the 0.8700 level as a crucial support. The pair shows a bullish bias, but a failure to surpass the 0.8755 high could invite bearish activity. Key levels to watch include resistance at 0.8800 and 0.8834, with support at the 200-DMA