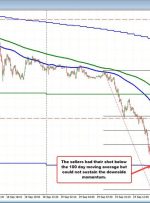

[ad_1] CRUDE OIL PRICES OUTLOOK Oil prices soften after Monday’s strong rally. Despite Tuesday’s move, geopolitical tensions in the Middle East create a constructive backdrop for energy markets in the near term. This article looks at oil’s key technical levels to watch in the coming days and weeks. Trade Smarter – Sign up for the