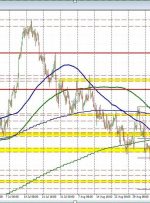

The US dollar has moved lower after the University of Michigan data came in weaker than expectations. The one year inflation expectation came in at 3.1% versus 3.5%. The 5 year inflation expectations was at 2.7% versus 3.0%. The sentiment indices were also lower than expectations. EURUSD: The EURUSD was trying to hold below a