[ad_1] © Reuters. In recent currency market movements, the US dollar has softened, touching its lowest point for November. The Bloomberg Dollar Spot Index (BBDXY), which tracks the greenback against a basket of other major currencies, has descended to a nadir for the month. The Japanese yen, on the other hand, has seen appreciation amid

[ad_1] Share: WTI crude oil prices declined following the start of a truce in the Gaza Strip. OPEC+ postpones crucial meetings, sparking speculations of potential oil production cuts for 2024. Global factors like higher US crude stockpiles, China’s uncertain oil demand, and non-OPEC production growth contribute to Oil price trends. West Texas Intermediate

[ad_1] The exchange rate witnessed a notable drop to 17.17 during European trading hours today, as market participants digest the culmination of the Federal Reserve’s interest rate hikes and anticipate further economic indicators from S&P Global PMI data. Earlier this week, on Tuesday, the Federal Open Market Committee (FOMC) released minutes that were perceived as

[ad_1] Share: USD/JPY falls below the key 150.00 level, trading at 149.76, down 0.64% amidst a shift in market sentiment. US housing data shows resilience with Building Permits and Housing Starts exceeding expectations but fails to support USD/JPY. Bank of Japan Governor Kazuo Ueda emphasizes the need for patience in monetary policy, linking

[ad_1] © Reuters. FILE PHOTO: Four thousand U.S. dollars are counted out by a banker counting currency at a bank in Westminster, Colorado November 3, 2009. REUTERS/Rick Wilking/File Photo By Karen Brettell NEW YORK (Reuters) – The dollar dipped against the euro on Friday but gained against the yen as investors evaluated comments by Federal

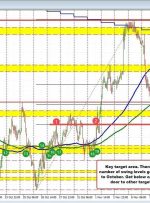

[ad_1] The AUDUSD is down for the 5th consecutive day. Recall on Friday last week, and then on Monday, the price of the AUDUSD was testing/moving above it’s key 100-day MA near 0.6515. The high price reached 0.65224, but ultimately stalled and started a run to the downside, leading to a move from 06522 to

[ad_1] © Reuters. The exchange rate experienced a downturn today, impacted by strong Australian retail data and concerns about the UK economy. This follows last week’s dip in the currency pair due to disappointing UK labor market indicators and anticipation of a rate hike by the Reserve Bank of Australia (RBA). Australia’s robust retail data,

[ad_1] Share: GBP/USD registers minimal losses of 0.12% after hitting a daily high of 1.2163 on risk appetite, but news headlines showing an escalation of the Middle East conflict weighed on the major. Therefore, the pair reversed its course trades at 1.2112, as sellers eye a test of 1.2100. Read More… The