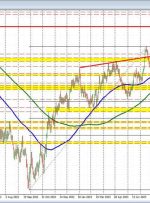

[ad_1] Share: The USD/SEK pair witnessed a 0.30% drop, hovering around the 10.452 level. Mixed S&P PMIs make the US struggle to gather demand. Riksbank’s hawkish hold on Thursday strengthened the SEK as the bank didn’t rule out a hike in 2024. The Swedish Krona (SEK) is gaining ground against the US Dollar (USD)