[ad_1] SPX weekly chart Closing changes: S&P 500 +0.2% DJIA +0.3% Nasdaq Comp flat Russell 2000 +1.0% Toronto TSX Comp +1.2% Weekly: S&P 500 +2.5% DJIA +1.4% Nasdaq Comp +3.2% Russell 2000 +3.6% Toronto TSX Comp +3.5% There were some larger divergences with energy leading the way today behind a 2.0% rise in the XLE

[ad_1] The major European indices rebounded into the close and in doing so moved into positive territory. A snapshot of the market closing levels shows: German DAX, up 10.35 points or +0.07% Frances CAC, up 15.14 points or +0.21% UK’s FTSE 100 up 4.93 points or +0.07% Spain’s Ibex up 14.20 points or +0.15% Italy’s

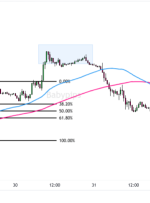

[ad_1] USDJPY back down testing the lows The early buying of the USD in the North American session, took the price above its 100-hour moving average near 145.70. The high price reached 145.755 and 145.733 consecutive hourly bars. However, momentum could not be sustained (with the next key target at 145.90), and short-term buyers were

[ad_1] Our strategists had an extraordinary week with arguably four out of four strategy discussions catching solid moves in FX and gold! Our anticipation of global risk-off vibes played out well, so read further to see how fundamentals drove price and what lessons can be learned for your own trading! NZD/USD 1-Hour Forex Chart by

[ad_1] In a mostly quiet volatility week, our strategy discussions arguably went well, including strong bullish moves in USD/JPY and GBP/NZD. Let’s do a quick review and see how the strategies played out! USD/JPY 2-Hour Forex Chart by TV On Monday, our strategists pulled up on USD/JPY, wondering if the fresh decline in the pair

[ad_1] JAPANESE YEN PRICE, CHARTS AND ANALYSIS: Recommended by Zain Vawda Get Your Free JPY Forecast Most Read: GBP/USD Hovers at Key Inflection Point Ahead of Inflation and GDP Data The Japanese Yen has continued its struggles this week losing ground to both the Greenback and the British Pound. This comes despite the recent policy

[ad_1] Eurostoxx +1.1% Germany DAX +0.9% France CAC 40 +1.3% UK FTSE +0.8% Spain IBEX +0.8% A good start for European stocks but this comes after the strong dip buying in Wall Street yesterday. The overall mood is also keeping steadier today with S&P 500 futures seen up 0.15% at the moment. In FX, the

[ad_1] An initial move higher in Wall Street last Friday eventually faded into the close (DJIA -0.43%; S&P 500 -0.53%; Nasdaq -0.36%), as market participants took the opportunity for further profit-taking into the seasonally weaker month of August. The focus was on the US July non-farm payroll report, which saw a miss in job addition