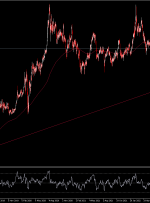

[ad_1] GBP PRICE, CHARTS AND ANALYSIS: Read More: Bitcoin Technical Outlook: Price Action Remains Choppy Heading into Q4 GBP has arrested its slump with a midweek recovery largely thanks to a recovery in overall risk sentiment. Cable has been the bigger beneficiary as the improving risk sentiment has seen the Dollar Index and US Treasury