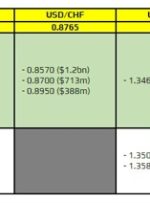

There are a couple to take note of, as highlighted in bold. The first ones being for EUR/USD with large ones at 1.0800 and 1.0900-10 being the more significant ones I would say. The former sits near key technical levels as supported by price action yesterday while the latter keeps just below the 100-day moving

AUD/USD ANALYSIS & TALKING POINTS Lack of Chinese stimulus weighs on Aussie dollar. RBA’s higher for longer > Federal Reserve. Turnaround or continuation for AUD/USD? Recommended by Warren Venketas Get Your Free AUD Forecast AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP The Australian dollar is trading at extreme levels this Monday as the PBoC decided to modestly reduce

STOP! From December 19th, 2022, this website is no longer intended for residents of the United States. Content on this site is not a solicitation to trade or open an account with any US-based brokerage or trading firm By selecting the box below, you are confirming that you are not a resident of the United

© Reuters. FILE PHOTO: Chinese Yuan and U.S. dollar banknotes are seen in this illustration taken March 10, 2023. REUTERS/Dado Ruvic/Illustration By Joice Alves and Samuel Indyk LONDON (Reuters) – Sterling rose on Tuesday after data showed British basic wages grew at a record pace, adding to the Bank of England’s inflation worries, while the

Brazil’s central bank, Banco Central do Brasil, has cut its benchmark rate, Selic target rate, by 50 basis points. The consensus was for a 25bp cut. The Bank says that 25 was considered but the improvement in inflation dynamics was enough for a 50 point move: the current situation demands serenity and moderation in the

© Reuters. Investing.com — Most Asian currencies fell on Wednesday after Fitch cut the U.S. government’s sovereign rating, although the dollar was little changed, retaining most of its recent gains on strong economic data. Fitch trimmed the U.S.’ rating to AA+ from AAA, citing concerns over stretched fiscal spending in the coming years, as well