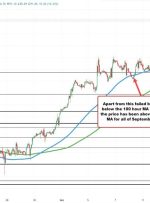

[ad_1] CRUDE OIL, WTI, NATURAL GAS, NG – Outlook: Crude oil’s break above key resistance points to further rise. Immediate downside risks in natural gas haven’t been eliminated. What is the outlook for crude oil and natural gas and what are the key levels to watch? Recommended by Manish Jaradi Futures for Beginners Crude Oil: