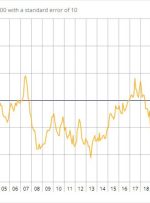

[ad_1] Prior -5 Economic sentiment -12 vs -17 Ability to save +10 vs +13 The Belgian business sentiment survey is a leading indicator but this one isn’t as closely followed. Still, it shows consumers hanging in there. This article was written by Adam Button at www.forexlive.com. [ad_2] لینک منبع : هوشمند نیوز