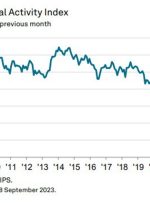

[ad_1] The downturn in September is led by a slump in house building as output also saw its steepest decline since May 2020. Adding to that, new orders also suffered its fastest pace of decline in over three years. S&P Global notes that: “Output levels declined across the UK construction sector for the first time