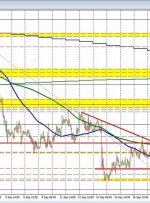

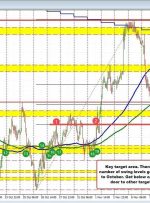

The AUDUSD is down for the 5th consecutive day. Recall on Friday last week, and then on Monday, the price of the AUDUSD was testing/moving above it’s key 100-day MA near 0.6515. The high price reached 0.65224, but ultimately stalled and started a run to the downside, leading to a move from 06522 to the