© Reuters. Investing.com – The U.S. dollar gained in early European trade Tuesday, as traders turned to this safe haven after disappointing Chinese services activity hit risk-taking sentiment. At 03:00 ET (07:00 GMT), the Dollar Index, which tracks the greenback against a basket of six other currencies, traded 0.3% higher at 104.382, close to three-month

SPX weekly chart Closing changes: S&P 500 +0.2% DJIA +0.3% Nasdaq Comp flat Russell 2000 +1.0% Toronto TSX Comp +1.2% Weekly: S&P 500 +2.5% DJIA +1.4% Nasdaq Comp +3.2% Russell 2000 +3.6% Toronto TSX Comp +3.5% There were some larger divergences with energy leading the way today behind a 2.0% rise in the XLE ETF.

The major European indices rebounded into the close and in doing so moved into positive territory. A snapshot of the market closing levels shows: German DAX, up 10.35 points or +0.07% Frances CAC, up 15.14 points or +0.21% UK’s FTSE 100 up 4.93 points or +0.07% Spain’s Ibex up 14.20 points or +0.15% Italy’s FTSE

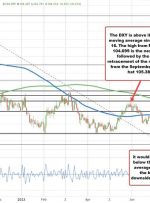

With the month ending next Thursday, what moves did we see in August? The USD moved higher versus all the major currencies: DXY: Looking at the dollar index (weighted dollar index), it moved up 2.28% this month. Looking at the daily chart, the price started the month trading above and below the 100-day moving average

Share: Cleveland Federal Reserve President Loretta Mester told CNBC on Friday that they probably have some more work to do with rates, per Reuters. Additional takeaways “We are getting close to where we need to be with rates.” “We need to see more evidence inflation is cooling.” “Economy momentum has been stronger.” “Fed

Closing changes in Europe: Stoxx 600 +0.7% German DAX +0.6% FTSE 100 +0.2% French CAC +0.6% Italy MIB +0.7% Spain IBEX +0.6% European stocks finished solidly higher but there was steady selling once the US came online. This article was written by Adam Button at www.forexlive.com. لینک منبع : هوشمند نیوز