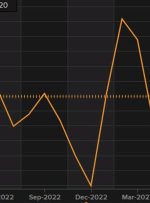

[ad_1] China’s run of low consumer inflation continues. And PPI continues to deflate y/y. The m/m PPI was +0.4%, rising oil a factor pushing it higher. Of more interest will be the trade data due some time around 0300 GMT (11pm US Eastern time). The release time is flexible. This article was written by Eamonn