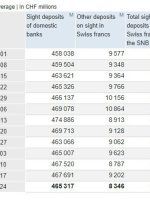

[ad_1] Domestic sight deposits CHF 465.3 bn vs CHF 467.7 bn prior Swiss sight deposits fall in the past week but still sits in the recent range of overall levels seen since the end of October. Here’s a snapshot: This article was written by Justin Low at www.forexlive.com. [ad_2] لینک منبع : هوشمند نیوز

[ad_1] Share: Economists at Citigroup expect the Swiss Franc (CHF) to weaken as the Swiss National Bank (SNB) may have ended its tightening cycle. CHF biased toward an extended period of underperformance The SNB’s pause at its September meeting at a 1.75% terminal rate likely signals an end to its tightening cycle which leaves

[ad_1] Share: The USD/CHF rose to a two-week high around 0.9035 near the 20-day SMA. The CHF is one the worst-performing currencies in the session. The US Dollar is trading soft after PCE figures from September. Hawkish bets on the Fed remain low ahead of next week’s meeting. At the end of the week,

[ad_1] China to hold its financial conference focused on economy, debt risks Goldman Sachs says FX outflows from China in September hit US$75 bln, biggest since 2016 Australian PM Albanese confirms he will meet with Communist Party Chair Xi in China in Nov Chinese police raided the Shanghai offices of a London-based firm, detained an

[ad_1] Domestic sight deposits CHF 463.6 bn vs CHF 459.5 bn prior Sight deposits rose in the last week but as a trend they have been moving lower in the months before, so there isn’t much to read into the rise in last week’s levels. This article was written by Justin Low at www.forexlive.com. [ad_2]

[ad_1] RBC Capital Markets provides a comprehensive look into the Swiss franc (CHF) as the Swiss National Bank (SNB) gears up for its third quarterly meeting of the year. The financial giant discusses its favourite CHF trade and offers an analysis of positioning in CHF pairs, notably USD/CHF. Key Points: SNB Meeting Anticipation: The forward