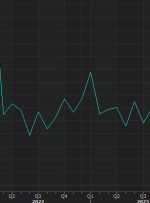

[ad_1] Trade Smarter – Sign up for the DailyFX Newsletter Receive timely and compelling market commentary from the DailyFX team Subscribe to Newsletter Most Read: Euro Weekly Forecast – EUR/USD, EUR/GBP Await ECB. Breakout or Breakdown Ahead? The Bank of Canada will announce its October monetary policy decision on Wednesday. The institution headed by Tiff