[ad_1] USD/CAD PRICE, CHARTS AND ANALYSIS: Read More: The Bank of Canada: A Trader’s Guide USDCAD Continues its slide today helped by a weaker US Dollar and a rebound in Oil prices. Having broken the ascending trendline on Friday the selloff has gathered a bit more momentum but faces some technical hurdles ahead. Despite more

[ad_1] EUR/USD Forecast – Prices, Charts, and Analysis FOMC minutes give little away, leaving the US dollar rudderless. UK Autumn Statement may give Sterling a boost. Download our Complimentary Guide to Trading EUR/USD Recommended by Nick Cawley How to Trade EUR/USD The Federal Reserve is very unlikely to cut interest rates anytime soon and may

[ad_1] BITCOIN, CRYPTO KEY POINTS: READ MORE: Oil Price Forecast: Recovery Continues as Expectations for OPEC Cuts Grow Bitcoin prices continue to hold the high ground but the $38k level remains a stumbling block. The rumors that an ETF approval would come by the November 17th failed to come to fruition with Bloomberg ETF analyst

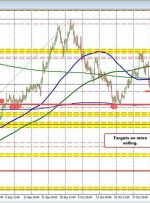

[ad_1] USDCHF remains below the 0.8900 level. Sellers in control. The tumble lower in the USDCHF took the price below its 100-day moving average at 0.8896 (blue overlayed step line on the chart above), 50% retracement at 0.88999, and Swing level near the 0.89000 level (see red circles on the chart above). Since then, the

[ad_1] XAU/USD, XAG/USD PRICE FORECAST: MOST READ: Japanese Yen Weekly Forecast: BoJ Tweak Fails to Inspire but Dollar Weakness Looks Promising for USD/JPY Gold prices are consolidating today following another attempt at the $2000/oz handle on Friday. Despite the weaker US Dollar we are seeing a slight recovery in US Yields and improving risk appetite