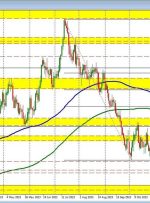

[ad_1] USDCHF remains below the 0.8900 level. Sellers in control. The tumble lower in the USDCHF took the price below its 100-day moving average at 0.8896 (blue overlayed step line on the chart above), 50% retracement at 0.88999, and Swing level near the 0.89000 level (see red circles on the chart above). Since then, the

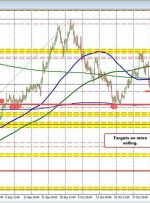

[ad_1] The GBPUSD is back below its 200 day moving average The GBPUSD ran higher yesterday, and in the process extended toward its 100-day moving average near 1.2512. The high price got within 7 pips of that level at 1.2505 before rotating back to the downside. In trading today, lower-than-expected CPI data out of the

[ad_1] Share: USD/CAD trades with a mild negative bias and is pressured by a modest USD downtick. The uncertainty over the Fed’s rate-hike path should help limit any meaningful USD fall. Bearish Oil prices might continue to undermine the Loonie and lend support to the pair. The USD/CAD pair ticks lower during the

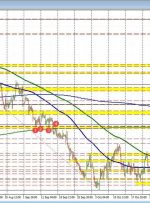

[ad_1] AUD/USD OUTLOOK: AUD/USD extends pullback after failing to clear overhead resistance around the 100-day simple moving average The breakout that took place last week appears to have been a fakeout This article looks at AUD/USD’s key technical levels to watch in the coming trading sessions Trade Smarter – Sign up for the DailyFX Newsletter

[ad_1] Share: USD/CHF fell to 0.9050, seeing 0.30% losses. The USD is losing interest due to the Fed dovish tone on Wednesday’s decision. Ahead of October’s Nonfarm Payrolls, the US reported weak labor market data. Indicators flash signals of further downside. In Thursday’s session, the USD/CHF saw red, mainly driven by a broad