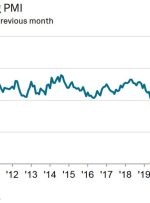

Services: 54.3 Composite: 52.6 Flash reading here: Last week we had the final manufacturing number: Earlier from Japan, the biggest y/y drop in household spending since February of 2021: ADVERTISEMENT – CONTINUE READING BELOW Tags ADVERTISEMENT – CONTINUE READING BELOW Most Popular ADVERTISEMENT – CONTINUE READING BELOW ADVERTISEMENT – CONTINUE READING BELOW لینک منبع :