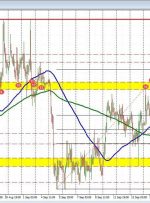

[ad_1] US Dollar Vs Euro, British Pound, Australian Dollar – Price Setups: USD boosted by higher for longer Fed rates after hawkish FOMC projections. EUR/USD and GBP/USD are testing quite strong support; AUD/USD has retreated from key resistance. What’s next for EUR/USD, GBP/USD, and AUD/USD? Recommended by Manish Jaradi New to FX? Try this link