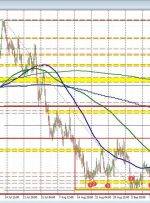

[ad_1] Share: The AUD/USD has walked back all of the day‘s gains in Friday trading as the DXY sees resurgence. Friday sees the Aussie down over 1% against the Greenback. A looming US government shutdown is seeing markets balk as investors clam up and jump back into the USD. The AUD/USD has slipped over