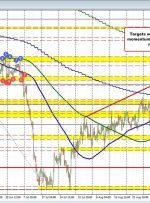

[ad_1] Share: Disney has been in a tremendous decline since it peaked at $203.02 back 03.08.2021. The Peak ended a Grand Super Cycle and since then it has corrected in larger pullback. The Elliott Wave Theory provides us with cycle degrees determined by the time each cycle lasts. So the Grand Super Cycle