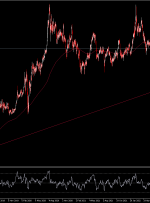

[ad_1] Last week’s decline in gold prices accelerated after the break of the current downtrend channel support. The last time Gold traded at such a low was six months ago, when the US regional banking crisis triggered an influx of buyers, pushing prices away from support around $1809. The biggest weekly loss in the last