EUR/USD ANALYSIS

- Fed > ECB last week contributing to euro weakness.

- Euro & US CPI the main attraction this upcoming week.

- EUR/USD bears hopeful for downside breakout.

Elevate your trading skills and gain a competitive edge. Get your hands on the Euro Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

The euro has been largely impacted by central bank speakers last week with the Federal Reserve winning the hawkish battle. Fed Chair Jerome Powell pushed back against dovish talk and left the door open for additional interest rate hikes if necessary – a net gain for the US dollar over the course of the week.

Poor Chinese economic data has not helped the euro with a continuing downward trend negatively impacting an already fading manufacturing sector within the region. Money markets have consequently priced in roughly 85bps of cumulative rate cuts by December 2024 vs the Fed’s 75bps, thus playing into the hands of the greenback via the carry trade. The USD remains favorable due in the current environment through a comparatively stronger economy as well as the ongoing war in the Middle East that plays into its safe haven allure.

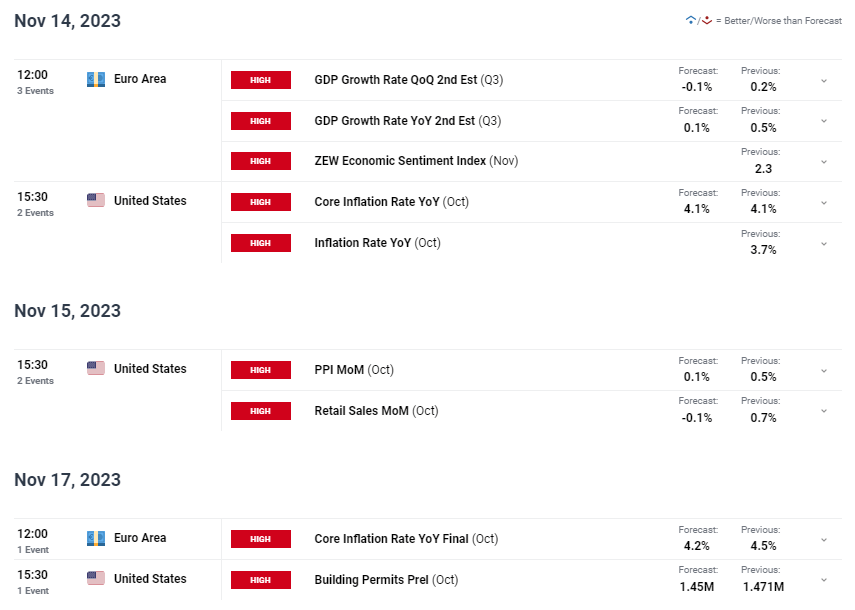

The week ahead (see economic calendar below) is relatively more action packed than last week with both euro area and US releases are scheduled throughout the week. Focus will be aimed at US CPI and euro CPI respectively. Euro area headline inflation is expected to drop sharply to 2.9% from 4.3% which could weigh negatively on the euro should this actualize.

ECONOMIC CALENDAR (GMT+02:00)

Source: Refinitiv

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

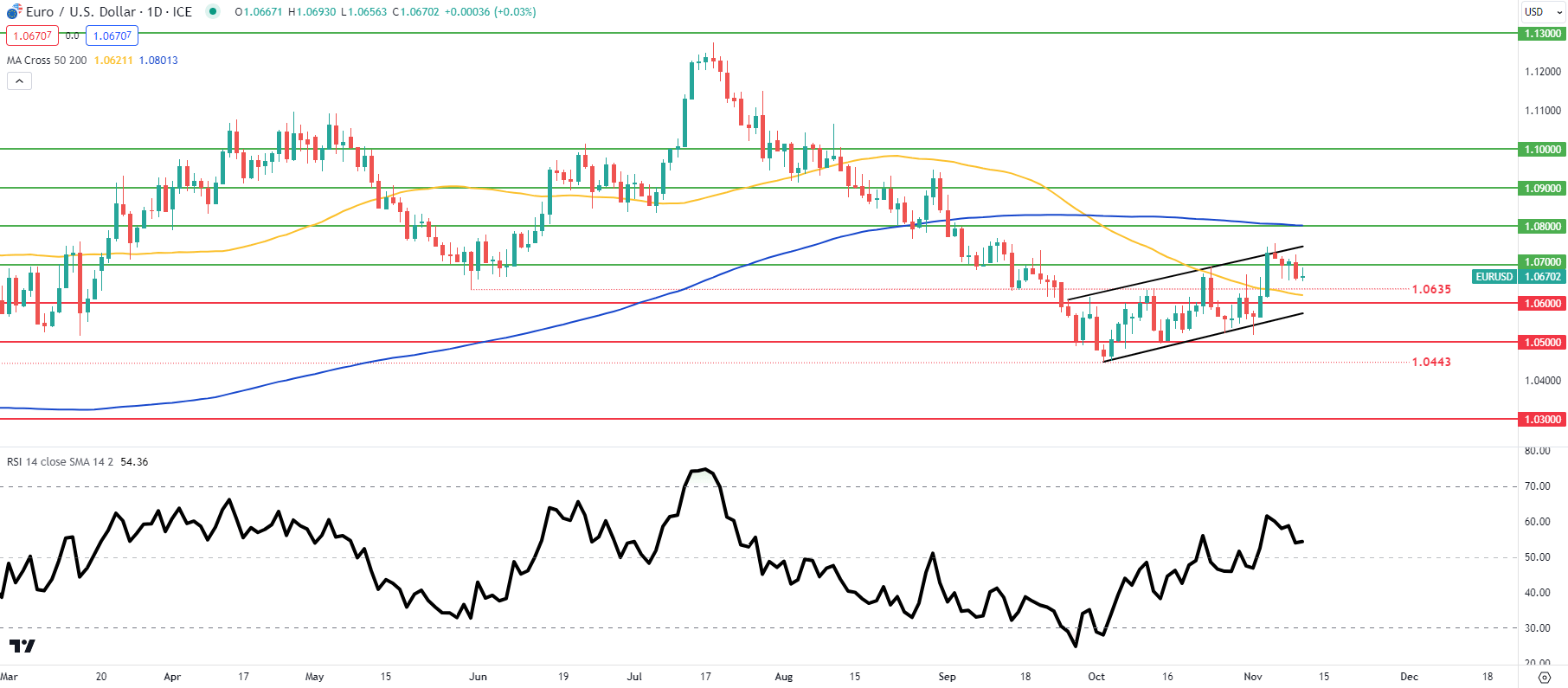

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The daily EUR/USD daily chart has once again failed to breach bear flag resistance and stays sandwiched between the 200-day moving average (blue) and 50-day moving average (yellow). Wlthough the pair is currently above the midpoint level of the Relative Strength Index (RSI), the technical pattern above suggests a bearish undertone should flag support break.

Resistance levels:

- 1.0800/200-day MA

- Flag resistance

- 1.0700

Support levels:

- 1.0635

- 50-day MA

- 1.0600

- Flag support

- 1.0500

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently neither NET LONG on EUR/USD, with 60% of traders currently holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect EUR/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0