Sterling Brushes Off PMI Data and Eyes Recovery

[ad_1] GBP PRICE, CHARTS AND ANALYSIS: Read More: Bitcoin Technical Outlook: Price Action Remains Choppy Heading into Q4 GBP has arrested its slump with a midweek recovery largely thanks to a recovery in overall risk sentiment. Cable has been the bigger beneficiary as the improving risk sentiment has seen the Dollar Index and US Treasury

[ad_1]

GBP PRICE, CHARTS AND ANALYSIS:

Read More: Bitcoin Technical Outlook: Price Action Remains Choppy Heading into Q4

GBP has arrested its slump with a midweek recovery largely thanks to a recovery in overall risk sentiment. Cable has been the bigger beneficiary as the improving risk sentiment has seen the Dollar Index and US Treasury Yield rallies stalled helping GBP/USD hold above the 1.2100 mark.

Q4 is underway now so do not lose valuable time and download the updated Q4 trading guide now.

Recommended by Zain Vawda

Get Your Free GBP Forecast

UK PMI DATA AND BOE SURVEY

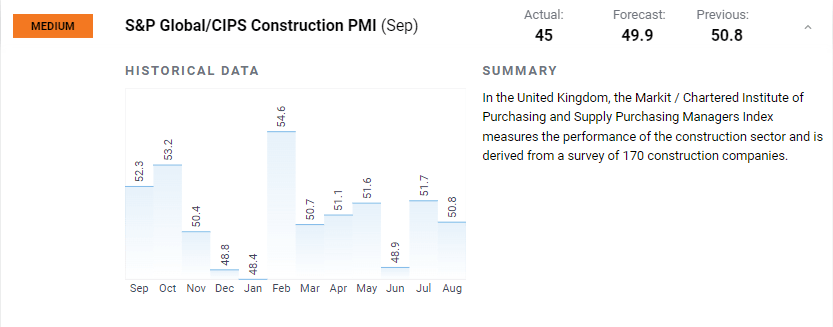

UK construction PMI data came in weaker than expected today and kept GBP gains in check against the Greenback. The S&P Global PMI report showed construction spending falling once more to 45.0 in September, quite the drop off from the previous release of 50.8. This now leaves both the construction and services PMI languishing in contractionary territory. The drop off in construction spending was expected however as higher mortgage rates continue to weigh on consumers. The S&P warned that the broader outlook is still sluggish with weak order books, a further sign of the weak demand environment in the UK.

Source: DailyFX Website

Bank of England (BoE) Governor Andrew Bailey meanwhile remains optimistic regarding inflation despite the potential for further inflation shocks. The Governor reiterated his belief of bringing inflation down below 5% and remains opposed to changing the UK’s inflation target of 2%.

The latest Bank of England (BoE) survey backed up Governor Bailey’s optimism around price pressure as the survey indicated price expectations are continuing to fall. The UK jobs market also showed signs of cooling, but Policymakers remain relatively weary of placing too much emphasis on surveys and are likely to wait on data confirmation before making any decision. The Survey also confirmed that the recent surprise hold of interest rates by the BoE was the correct decision. On the whole the survey and recent data from the UK seem to bode well for another hold at the upcoming November meeting but the actual data will likely be more important.

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

RISK EVENTS AHEAD

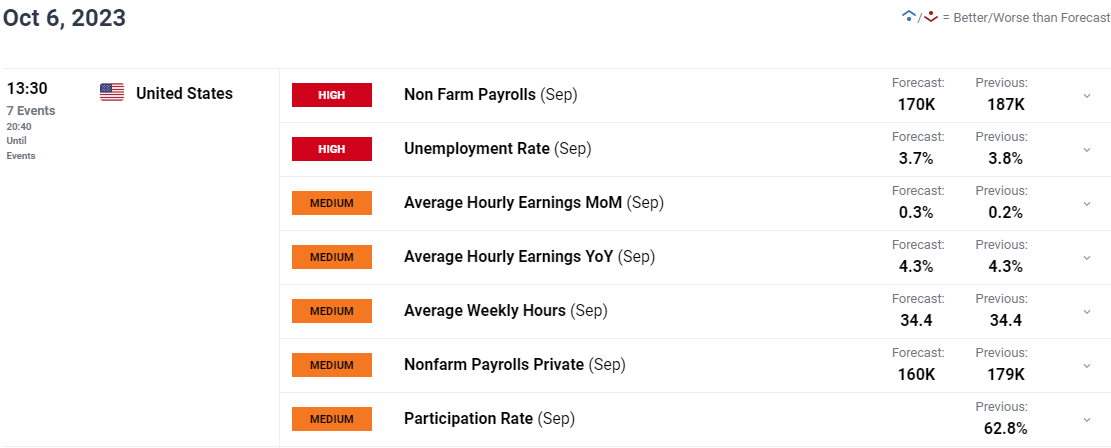

The end of the week brings about some key US data releases with no high impact data due from the UK and EU until next week. US Jobs data so far this week painted a mixed picture but still remains relatively resilient heading into NFP tomorrow. Jolts job openings remain strong, but we did see a slight loss of momentum in private sector hiring which makes tomorrows NFP print all the more interesting.

For all market-moving economic releases and events, see the DailyFX Calendar

PRICE ACTION AND POTENTIAL SETUPS

GBPUSD

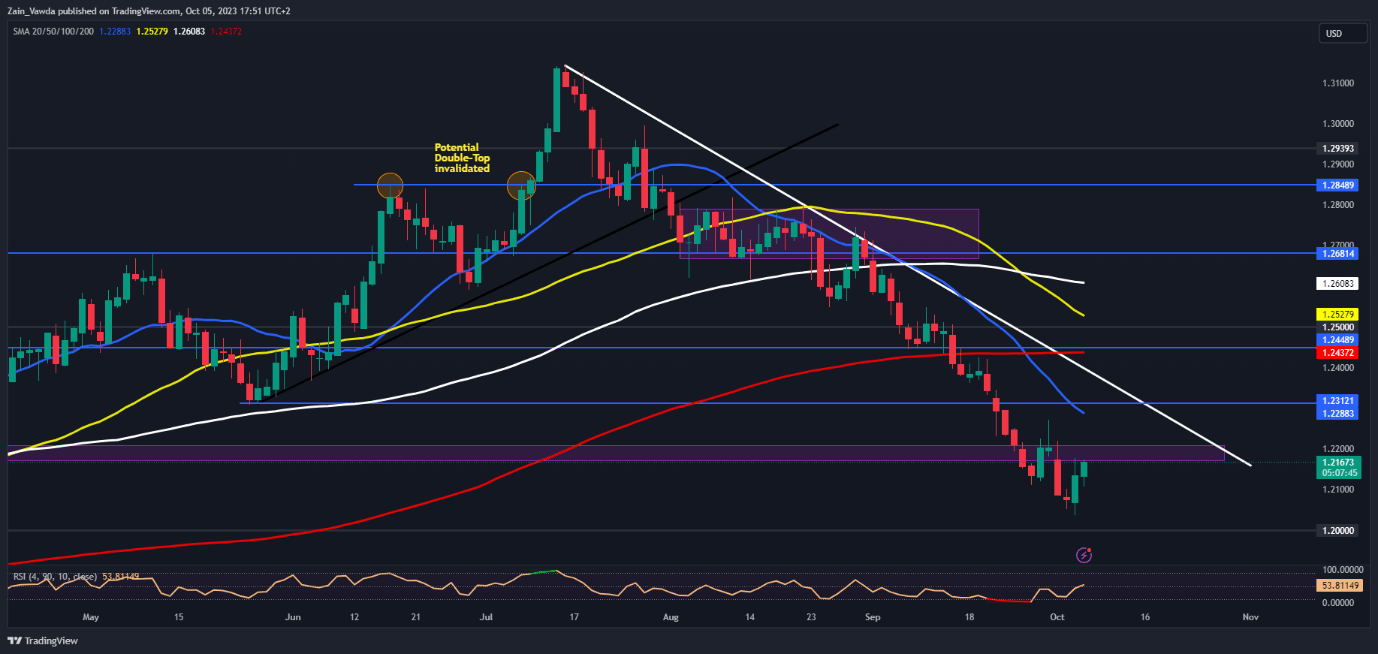

GBP/USD Daily Chart

Source: TradingView, Prepared by Zain Vawda

GBPUSD is enjoying a midweek renaissance ahead of the NFP report tomorrow. Cable came within a whisker of the psychological 1.2000 mark yesterday before a strong bounce saw the pair close back above the 1.2100 handle.

Asian and European session gains were wiped out following US data today before a sharp bounce from key support around the 1.2100 mark. The weakness in the US Dollar has certainly helped coupled with an improvement in risk sentiment. Looking at the bigger picture and we are at key resistance around the 1.2180-1.2200 area with a break above opening up the long-awaited 3rd touch of the descending trendline.

A return of US Dollar strength to end the week could end up pushing Cable back toward the 1.2000 mark.

Key Levels to Keep an Eye On:

Resistance levels:

Support levels:

- 1.2100

- 1.2030 (weekly low)

- 1.2000

EURGBP

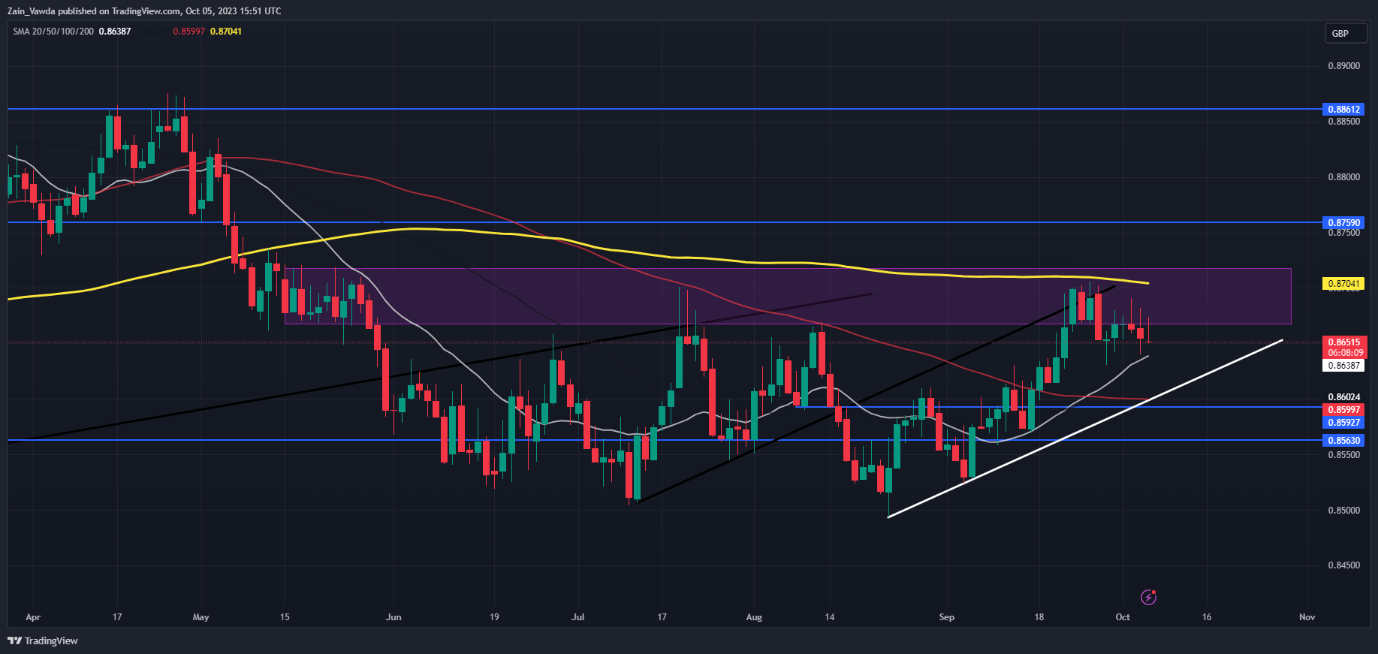

EUR/GBP Daily Chart

Source: TradingView, Prepared by Zain Vawda

From a technical perspective, EURGBP continues to struggle at the 0.8700 mark as the pair appears desined for a move lower once more. The resurgence in the Sterling has seen the pair print a lower high with a lower low seemingly on the way below the 20-day MA around the 0.8638.

A break below will bring the ascending trendline into focus with a short-term bounce of the dynamic support area remaining a possibility. There is also support on the downside provided by the 100-day MA around the 0.8600 mark. A retest of the YTD lo around the 0.8500 handle at this stage looks unlikely as the 200-pip range between 0.8500-0.8700 remains intact.

IG CLIENT SENTIMENT DATA

IGCS shows retail traders are currently Net-Short on EURGBP, with 53% of traders currently holding SHORT positions. Given the contrarian view adopted here at DailyFX, is EURGBP destined to rise above the 0.8700 mark?

To Get the Full Breakdown on How to Use IG Client Sentiment, Please Download the Guide Below.

| Change in | Longs | Shorts | OI |

| Daily | -2% | -3% | -3% |

| Weekly | -7% | 4% | -1% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0