S&P 500 Slides as US Yields Rise Post CPI, More Downside Ahead?

[ad_1] S AND P 500 PRICE FORECAST: Most Read: Mixed US CPI Data as Core Inflation Falls to 2 Year Lows, DXY Rises and GBP/USD Slides US Indices have run into trouble thanks to a combination of key resistance levels and a sticky Inflation print. The inflation data actually came in rather mixed in my

[ad_1]

S AND P 500 PRICE FORECAST:

Most Read: Mixed US CPI Data as Core Inflation Falls to 2 Year Lows, DXY Rises and GBP/USD Slides

US Indices have run into trouble thanks to a combination of key resistance levels and a sticky Inflation print. The inflation data actually came in rather mixed in my opinion with the headline inflation number remaining at 3.7% but above estimates of 3.6%. Core inflation YoY however fell to a 24-month low of 4.1%.

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the fourth quarter!

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

POST US CPI OUTLOOK AND BANK EARNINGS

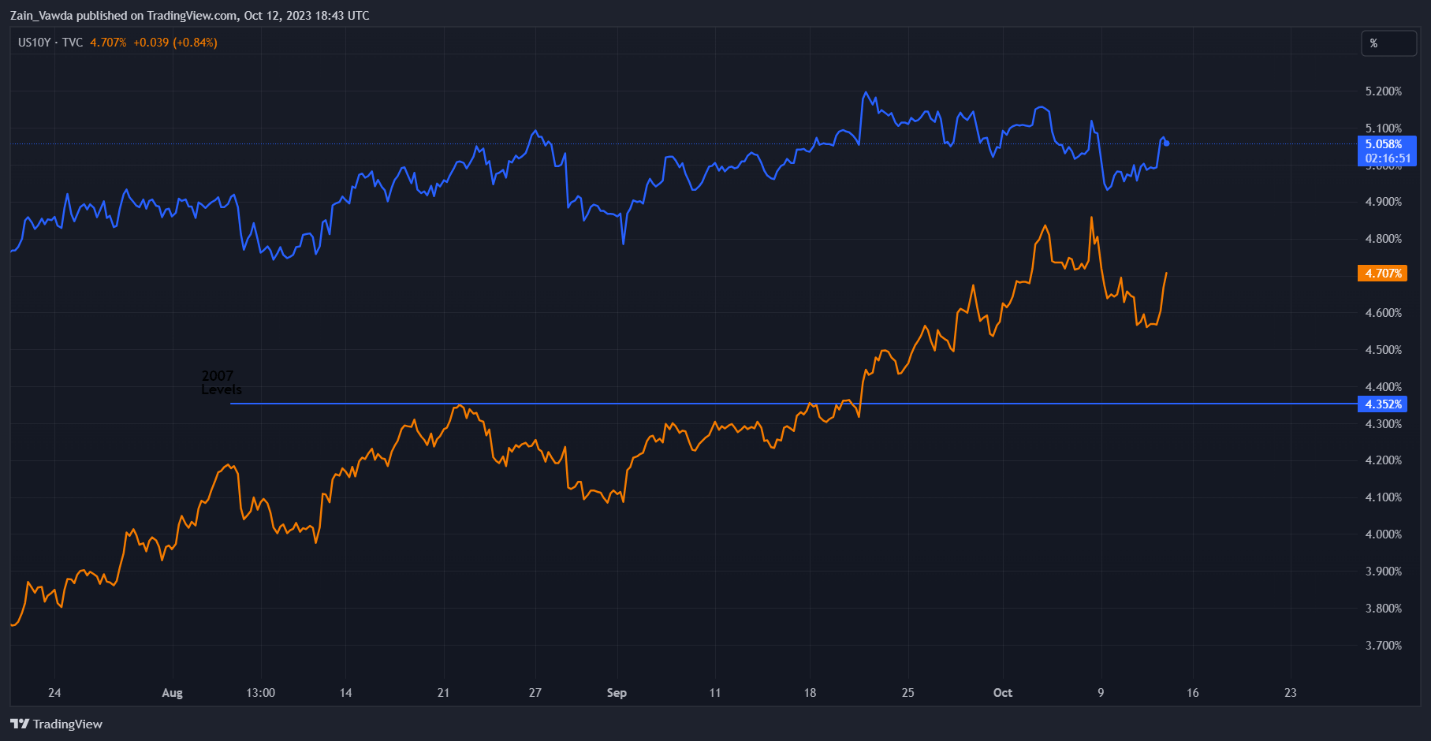

Despite the mixed nature of the US inflation data the US Dollar received a strong bid today as well as a sharp rise in long term US treasury yields. Now looking at the reaction and what I think has been the driving force of the rise in the US Dollar as well as the selloff in US equities comes back to Fed policymaker comments this week. A dovish tone was set for the majority of the week which kept the US Dollar on the back foot.

Comments from Rafael Bostic yesterday however may explain some of the moves today. Bostic said the stalling inflation could force the Federal Reserve to “do more”. Today’s print from a headline perspective can definitely be called sticky while with long term yield rates rising aggressively, even if the Fed do not hike rates again, today’s data still supports the narrative of “higher rates for longer”.

US 2Y and 10Y Yield Chart

Source: TradingView, Created by Zain Vawda

Another explanation of the selloff in the S&P 500 could be down to some profit taking from the recent upside rally ahead of US bank earning due tomorrow. This however doesn’t seem likely as Bank earnings are expected to be positive owing to the higher rate environment which has allowed banks to rake in a substantial amount of revenue over the last 18 months.

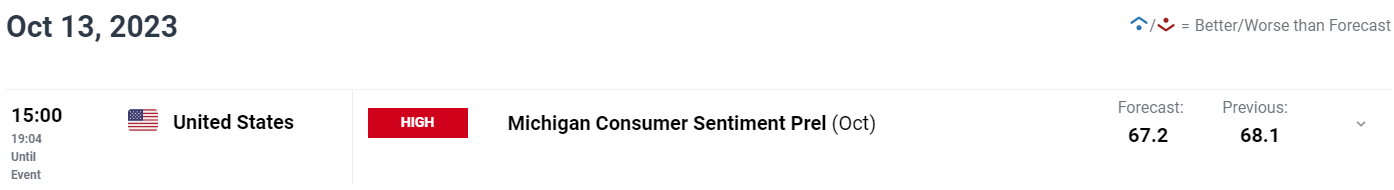

Either way markets will surely be keeping a close eye tomorrow on earnings season, with big banks including JPMorgan Chase, Wells Fargo and Citigroup reporting their quarterly numbers before the bell on Friday. We also have Michigan Consumer Sentiment data (Prel) due for release and we will hear more comments from Fed Policymaker Harker tomorrow as well.

Elevate your trading skills and gain a competitive edge. Get your hands on the U.S. Equities Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Zain Vawda

Get Your Free Equities Forecast

ECONOMIC CALENDAR

For all market-moving economic releases and events, see theDailyFX Calendar

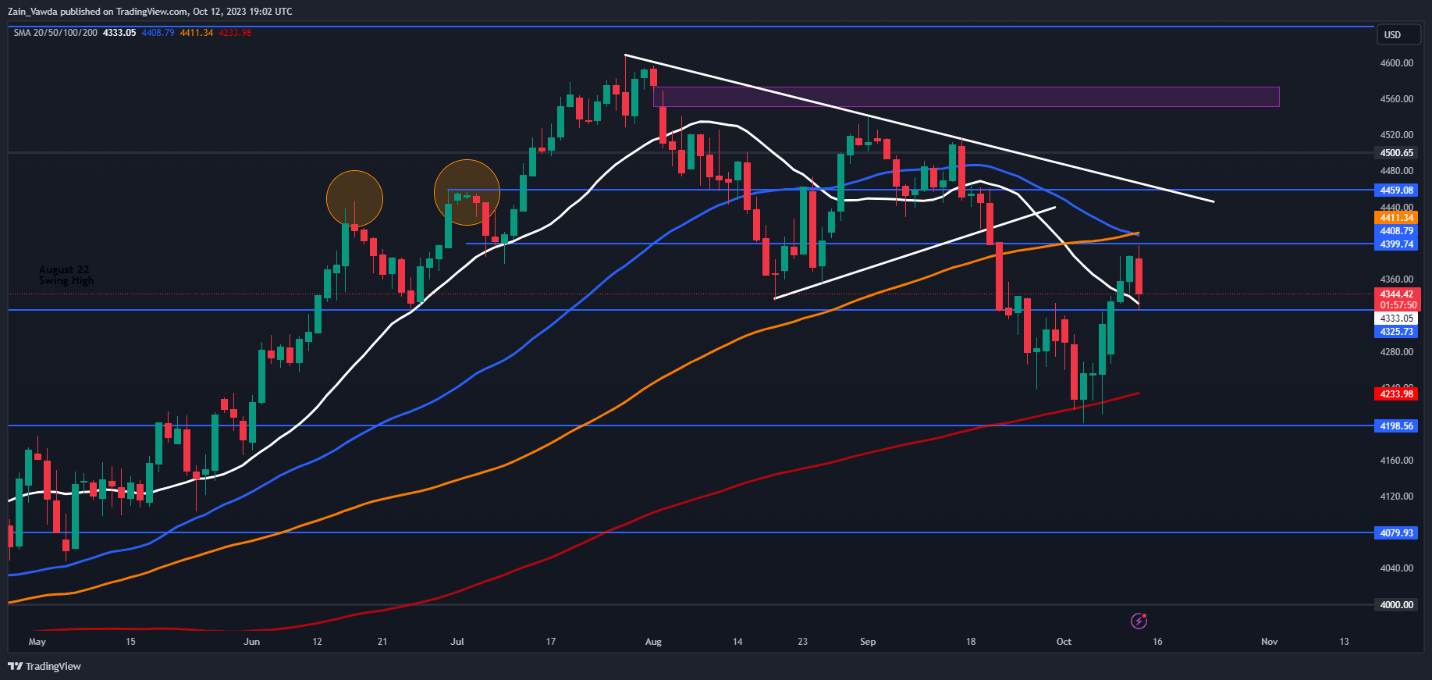

S&P 500 TECHNICAL OUTLOOK

Form a technical perspective, the S&P has bounced off a key area of support before rallying some 200 points toward the key resistance level resting at the 4400 mark. A further challenge for the S&P is the completion of a death cross pattern which would hint at further downside ahead as the 50-day MA crossed below the 100-day MA.

The price remains compressed between the moving averages as they are spread within a 180-point range. At the time of writing the S&P has put in a slight bounce of the 20-day MA and remains on course for a bearish close with losses currently at 0.95% on the day.

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

S&P 500 October 12, 2023

Source: TradingView, Chart Prepared by Zain Vawda

IG CLIENT SENTIMENT

Taking a quick look at the IG Client Sentiment, Retail Traders have shifted to a more dovish stance with 50% of retail traders now holding long positions compared to 57% a day ago.

For a more in-depth look at Client Sentiment on the SPX and how to use it download your free guide below.

| Change in | Longs | Shorts | OI |

| Daily | -1% | 3% | 1% |

| Weekly | -21% | 24% | -3% |

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

لینک منبع : هوشمند نیوز

آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA آموزش مجازی مدیریت عالی حرفه ای کسب و کار Post DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA آموزش مجازی مدیریت عالی و حرفه ای کسب و کار DBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |  آموزش مجازی مدیریت کسب و کار MBA آموزش مجازی مدیریت کسب و کار MBA+ مدرک معتبر قابل ترجمه رسمی با مهر دادگستری و وزارت امور خارجه |

مدیریت حرفه ای کافی شاپ |  حقوقدان خبره |  سرآشپز حرفه ای |

آموزش مجازی تعمیرات موبایل آموزش مجازی تعمیرات موبایل |  آموزش مجازی ICDL مهارت های رایانه کار درجه یک و دو |  آموزش مجازی کارشناس معاملات املاک_ مشاور املاک آموزش مجازی کارشناس معاملات املاک_ مشاور املاک |

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0